Big News! Vitable Health has acquired Liferaft

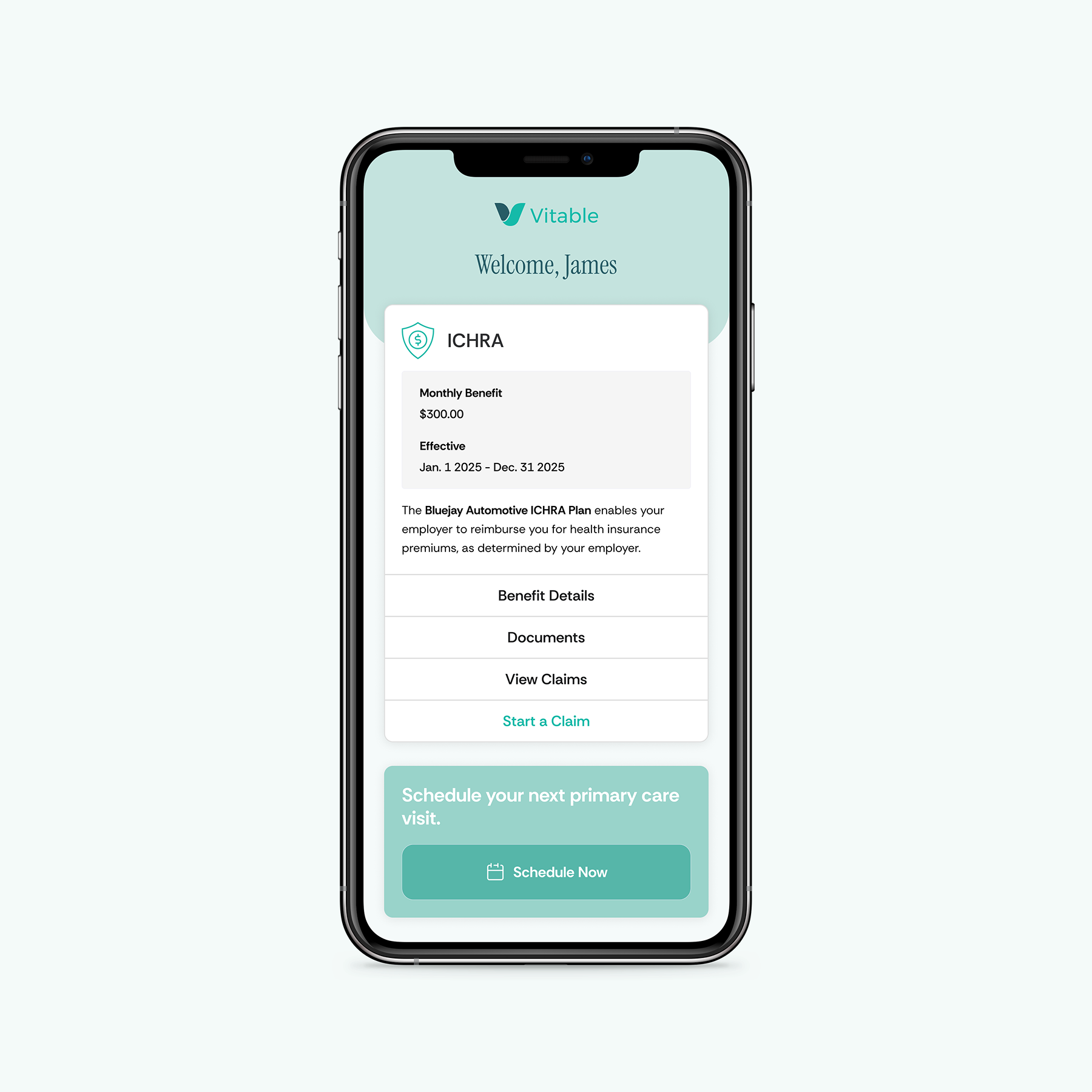

Vitable Health’s acquisition of Liferaft makes it the first to offer a vertically integrated ICHRA and virtual primary care platform that delivers lower costs, better care, and zero administrative burden.

Our Products

Reimagine Health Insurance With Our Technology

Liferaft is a technology-enabled administration platform that lets you build bespoke benefits programs tailored to your client's needs or your business requirements. Move beyond fully insured group health insurance and create unique, cost-effective health solutions that stand out.

Why Liferaft?

If you can imagine it, we can build it.

Tailored Solutions for Today's Challenges

Liferaft offers bespoke insurance solutions designed to meet the unique challenges of modern businesses and address evolving risks, rising costs, and the increasing need for flexible coverage options.

Seamless Integration & Automation

With Liferaft, seamless integration and automation is powered by cutting-edge technology, ensuring effortless management and administration to save time for your organization.

Expert Guidance & Support

Gain access to Liferaft's team of insurance experts who provide personalized guidance and support, offering insights and assistance in navigating the complexities of insurance structures, plan designs, and compliance requirements.